Gold – positioning for me was around 2020/21! Copper IS NOW!

By Tshepo Magagane

I was looking for structured offtake solutions for this Credit Fund at the time.

One company is chaired by my ex-boss!

They were going through PF – price was about USD1,200/oz.

He was happy to hear from me but immediately went “nope, thank you very much Tshepo, I have approached this PF exactly like I wanted…talk to me about anything else…not this”!

He has shaped how natural resources and the FTSE look eg he and Bristow once lobbed a bid for Ashanti after it agreed a deal with AngloGold – or I will never forget during Rio / Alcan – Rio told us we had no role – shouted at me across the floor and went “young Tshepo, send your models over then come to my desk, let me teach you how to create a NewCo” – idea was to put together assets that would fall out of the acquisition into a Levered LBO!

When you have seen these cycles, you notice them when they are forming…he held on so tight to the offtake during the financing!

They are paying their last tranche of the PF as we speak…

…they produce at about USD900/oz!

And majors are currently sitting at an AISCC of USD1,800/oz!

So, they can produce at USD1,200/oz and still turn cash, therefore at USD1,500/oz it is just money flowing to the bottom line…

…at majors cost structure of USD1,800/oz…they are just printing money…

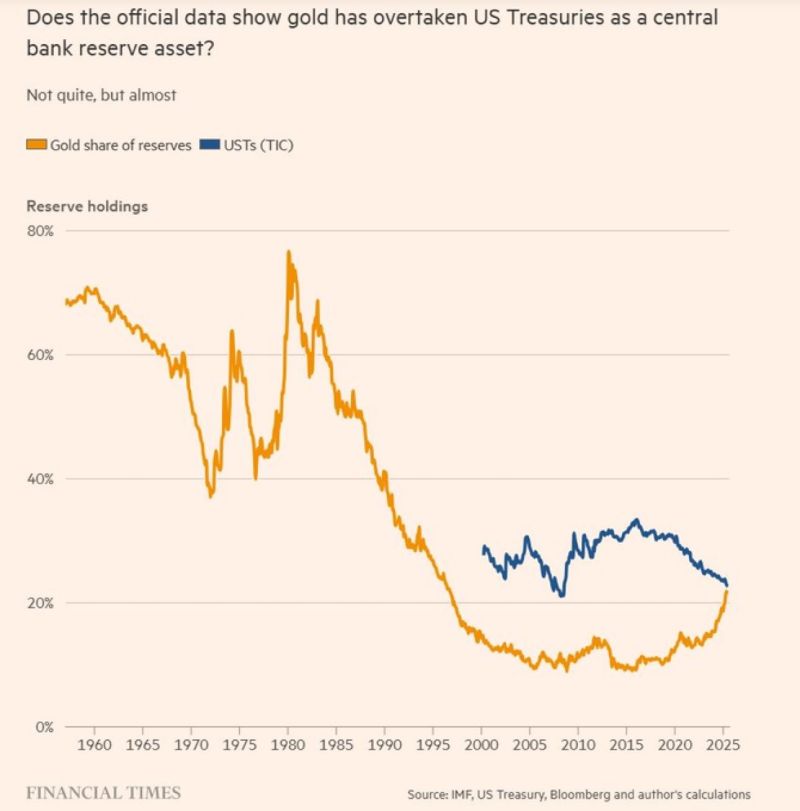

…then you start to play around with were central banks have been buying eg USD2,200/oz…

…this year at over USD3,000/oz…

…and then the decimation of the USD!

How you position in Commodities – why in Copper, the positioning was possibly 10yrs back but the next best positioning is spot with Copperbelt projects…

…they make money at current pricing ie can do PF and pay it back in 2yrs…

…before you start taking the price implied by P/NAV of CopperCos of about 1.5x-2.0x of current pricing and then brownfield of 3.0x…

…so you will be printing money with just that…see that I am not even talking about incentive pricing for SAmerican low grades which is 8.0x-10.0x!