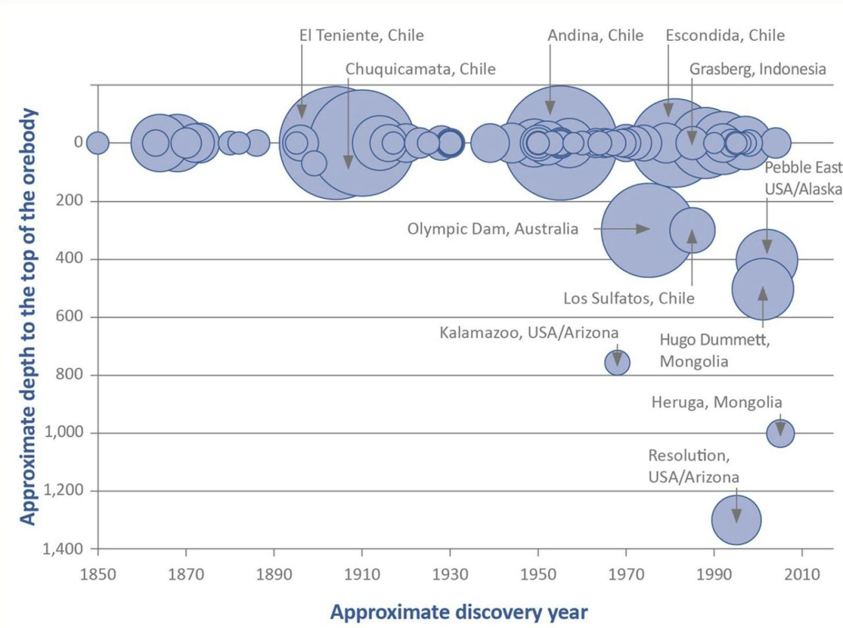

Copper Discoveries

Tshepo Magagane – Metals & Mining Executive

Mining companies that still go “Oh we are looking for Copper but not in ‘risky’ jurisdictions” still do puzzle me!

What is unfolding with Copper is something else – I thought what happened with Steel Making Raw Materials in the ’00s was a once-in-a-lifetime event!

It was not – current events in Copper are something else.

Spot, you will speak to a small smelter who will go “I am getting capital offers to expand but I simply don’t have the ore, I am not just going to take the money”!

Scouts for end-users are spending 12 months in the Copperbelt looking for new ore – if you are not invested at a very early stage, that ore will already be spoken for – simple fact!

Opportunities are there for Investors / Allocators BUT it is about finding the right teams to deploy the capital – it takes a broad set of skills – financial, geology, metallurgical, engineering, ESG, local relationships, networks in mining & finance!

It is about finding projects that can be brought online using current price decks – where will the Copper price settle in the LT? I don’t know but I know this, you need to double supply and a lot of that will come in at prices substantially higher than current – so if you can secure a portfolio of assets that generate cash at current prices; you will be sitting on a simple money-printing machine!

Low grade deposits means – higher Capex intensity + far higher OPEX (moving 6x more rock, more consumables, more labour, bigger plants, more water)!

Friedland said it best “you can’t have a portfolio without Copper in it, it is something you go long and just leave for your grandchildren”!