Navigating the Complex Terrain of De-dollarisation

Views and Thoughts By Ceaser Siwale – Chief Executive Pangaea Securities

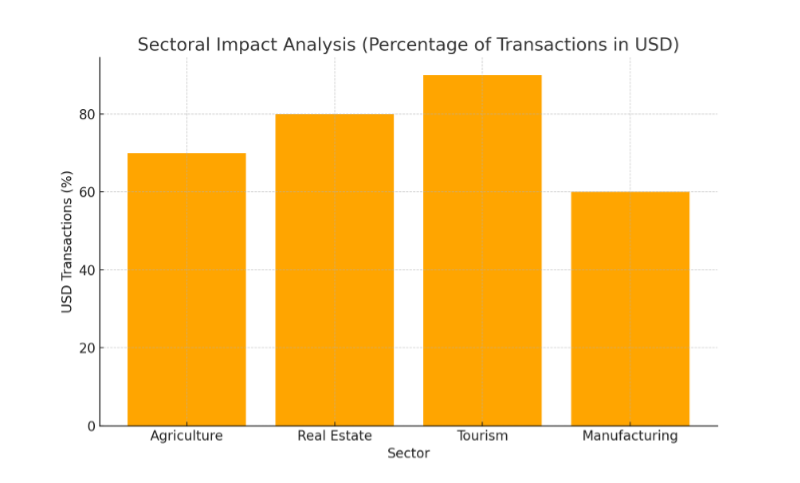

The recent initiative by the Bank of Zambia (BoZ) to explore de-dollarisation has sparked a debate among various stakeholders. The BoZ’s proposal to limit the use of the US dollar in domestic transactions, with certain exceptions like exports, tourism, and large infrastructure projects, is seen as a strategic move to bolster the Kwacha’s standing. However, this initiative has generated a divide within the business community, particularly between landlords who prefer dollar-based rents and suppliers of agriculture seasonal inputs, and tenants and farmers who argue that selling in Kwacha imposes the exchange rate risks on to them.

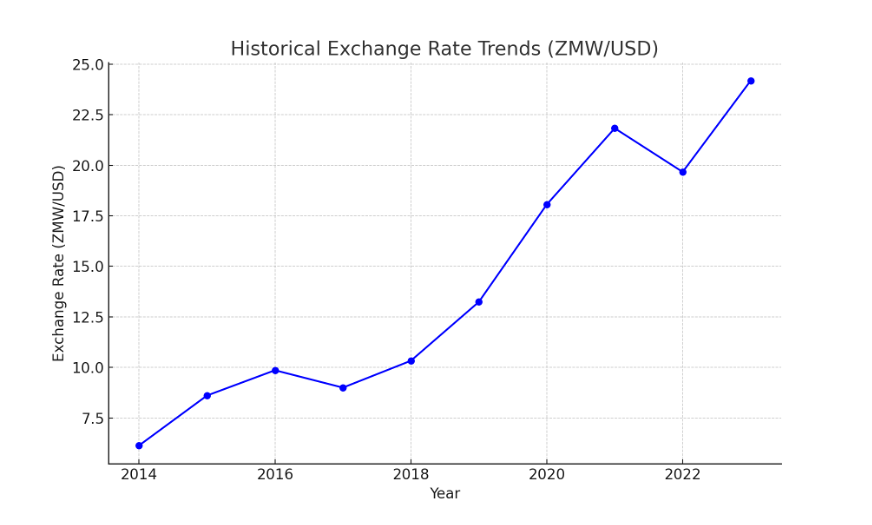

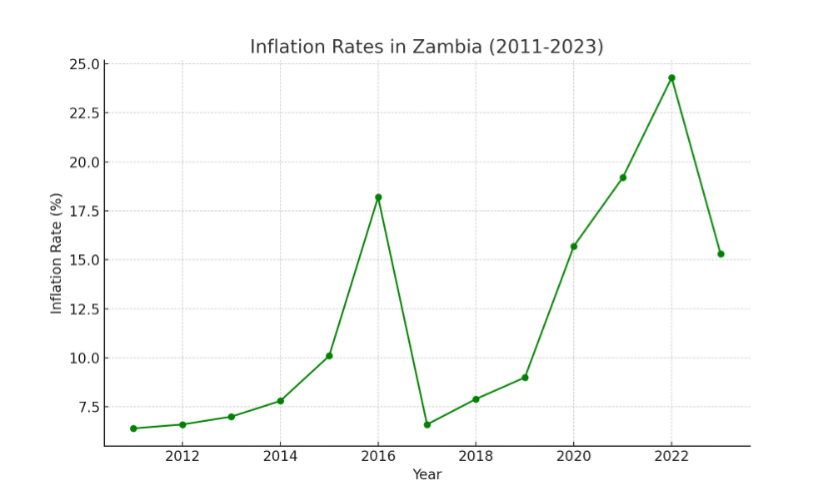

Zambia’s economy, like many others in the region, has long been dollarised, with a significant portion of transactions conducted in US dollars. This reliance on foreign currency is rooted in historical economic volatility, persistent inflation, and a volatile exchange rate environment that has eroded confidence in the local currency. De-dollarisation, therefore, is seen as a measure to strengthen the Kwacha and improve the effectiveness of monetary policy.

However, such measures are with risks. Countries that have attempted forced de-dollarisation have often faced severe economic disruptions, as evidenced by experiences in Zimbabwe and Angola. The success of such policies depends heavily on macroeconomic stability, institutional capacity, and careful implementation—areas where Zambia faces significant challenges.

The Case for De-dollarisation

Proponents of de-dollarisation argue that reducing the economy’s dependence on the US dollar would enhance the Bank of Zambia’s ability to conduct effective monetary policy, which currently needs to be revised by the widespread use of foreign currency. This, in turn, could lead to greater economic stability, reduced inflationary pressures, create local currency financial products and improved fiscal discipline.

Moreover, de-dollarisation could foster greater national economic independence, reducing vulnerability to external shocks and enhancing the country’s ability to manage its economy in line with national priorities. For example, ensuring that domestic transactions are conducted in Kwacha could help stabilise the currency, encourage savings, and potentially lower the cost of borrowing in the local market.

The Case Against De-dollarisation

On the other hand, critics warn that forced de-dollarisation, especially in the current economic environment, could lead to unintended consequences that outweigh the potential benefits. These include:

1. Economic Disruptions: For sectors heavily reliant on foreign currency, such as real estate, agriculture, and large-scale infrastructure projects, forced conversion to Kwacha could lead to significant financial losses, defaults, and a reduction in investment. The agricultural sector, for instance, relies on imported inputs priced in US dollars. A sudden shift to Kwacha invoicing could expose input suppliers and farmers to severe foreign exchange risks, potentially disrupting the agricultural value chain and threatening food security.

2. Increased Inflation: Historical data suggests that de-dollarisation efforts could exacerbate inflationary pressures if not carefully managed. In Zambia, inflation is already high, driven by structural factors such as low production, high import costs, and volatile exchange rates. The introduction of currency regulations could lead businesses to hedge against further Kwacha depreciation by raising prices, thus fueling inflation rather than controlling it.

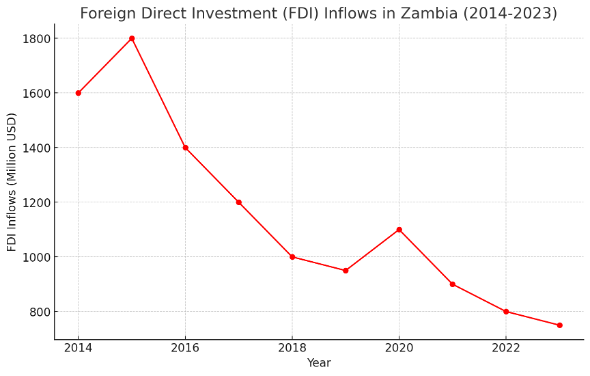

3. Impact on Investment: The US dollar’s predictability and stability make it an attractive currency for foreign investors. Forcing businesses to transact in Kwacha could deter foreign direct investment (FDI), which is crucial for Zambia’s economic growth. The real estate market, for example, might suffer from reduced property yields and devaluation if rents are mandated to be in Kwacha. This could further strain an already fragile economy.

4. Financial Sector Risks: The financial sector could face amplified risks due to currency mismatches and exchange rate shocks. Banks might experience increased vulnerability, potentially leading to a more cautious lending environment, which could stifle economic activity and slow down growth.

Policy Recommendations

Given the complex trade-offs involved in de-dollarisation, a phased and measured approach is recommended:

1. Phased Implementation: The Bank of Zambia should consider introducing de-dollarisation measures gradually, including a grace period for businesses to adjust to the new regulations. This approach would allow for continuous stakeholder consultation and the adjustment of policies based on real-time feedback and economic performance.

2. Sectoral Exemptions: To avoid disrupting critical economic activities, key sectors such as agriculture, tourism, and large-scale infrastructure should be granted exemptions or phased differently. For instance, large-scale agriculture that relies on US dollar-denominated credit lines for input purchases should be allowed to use foreign currency, at least in the short to medium term, to ensure food security and sector stability.

3. Strengthening the Financial Sector: The BoZ should work to develop sophisticated financial instruments that allow businesses to hedge against exchange rate risks in Kwacha, thereby reducing their reliance on the US dollar for stability. This includes promoting local currency trade agreements, improving access to Kwacha liquidity, and lowering borrowing costs in the local currency.

4. Delaying Implementation: It may be prudent to delay the full implementation of de-dollarisation policies until after the 2026 presidential elections, allowing the economy to stabilise and for essential reforms to take root. This period could also strengthen the institutional capacity needed to enforce these regulations effectively.

Therefore…

The path to de-dollarisation in Zambia is fraught with challenges but also offers potential rewards if managed carefully. Balancing the need for economic independence with the practical realities of a highly dollarised economy requires careful consideration, robust stakeholder engagement, and a phased, adaptive approach. By navigating this complex terrain cautiously, Zambia can reap the benefits of a more robust, more resilient economy without sacrificing stability or growth.