Iron ore – It Has Vast Ramifications!

By Tshepo Magagne – Executive Metals & Mining

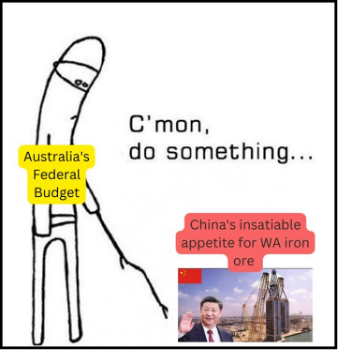

WA Iron Ore has a lower cost structure, but if you input USD60/t v USD80/t in LT, you can immediately tell that it is going to impact Royalties, Sales Taxes, PAYE, and Corporate Taxes…

So Australia has to find a way to plug that gap in taxes! An Aussie in the mining industry said, “The average Aussie does not really appreciate the role that iron ore has been playing in the economy over the past two decades”—even the politicians— I remember one last year being snarky about mining!

However, at least they paid for the Infrastructure!

The same will go for Vale in Brazil—base metals are going to be key, and others, such as Kumba in South Africa!

Transnet really did Kumba wrong in South Africa. If they had even given a 15-year rail concession to Anglo, I am certain that Kumba would have produced 120-150Mtpa. And think of that cash—it is literally cash when it comes to bulks!

For South Africa, it will be important how they play the Manganese story. There is a huge, huge opportunity there with the country sitting on most of the commodity’s resources. It will go down the Specialty Chemicals route, and with the country’s research capacity, skillset, institutions, already existing auto industry, and some lithium around the Capes, a bold strategy around precursor or even cell manufacturing can work!

Changing times…Transition opportunities are not the same; you have to do far, far more work, e.g. Copper – I agree with Friedland; you can’t afford not to have in your portfolio and others as well, e.g. Gold – fiat is tinkering on edge and as the saying goes “gold is the only currency”!